SERVICES >> TAX

By keeping current on Myanmar Tax Law and Legislation, we are in a position to identify key tax planning opportunities that minimize both your current and future tax liabilities. We provide our individual and business clients with the taxation expertise and knowledge that they deserve throughout the year.

The following several tax filling services will include.

I.Assistance with Tax Registration (Commercial Tax/Corporate Tax)

The Tax Registration is an important component of the compliance of Myanmar Tax Regulations and the all forms of tax returns are needed to prepare under company tax registration pin numbers which can be shared between suppliers and customers to enjoy the facilities of tax offsets. KAMP team can be able to take care of Tax Registration Process for our clients to ensure annual tax registration at particular tax offices.

II.Calculation and Filing of Personal Income Tax

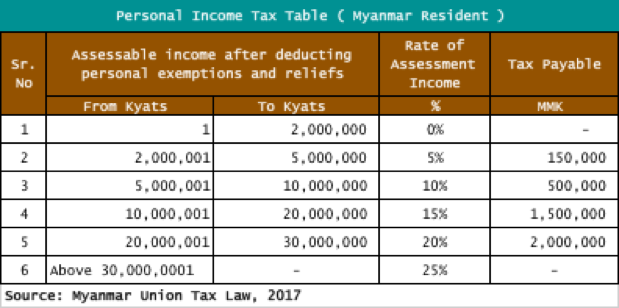

Personal income tax in Myanmar is progressive in nature and personal income of up to MMK 4,800,000 attracts 0% of tax and above MMK 4,800,000 is charged from 0% to 25% with basic exemption of 20% on total annual earning.

Rates applied to Myanmar Residents & Non-Residents are different and 25% of total earning imposed as personal income tax for non-residents foreigners only on income derived within Myanmar. However, foreigners working under Myanmar Foreign Investment Law or Myanmar Investment Law may be taxed at the same tax rates as a tax resident, regardless of their numbers of stay in Myanmar as an incentive to MFIL/MIL companies.

The following table has shown as Personal Income Tax Rates for Residents.

To lessen the risk of personal income tax matter, KAMP team offers calculation and filing of personal income tax for both residents and non-residents. Our experts consult with individual client and pleased to submit our service proposal for management review.

III. Calculation and Filing of Commercial Tax

Generally, commercial tax is imposed at the rate of 5% on goods and services and the business charges and collects is recognized as output tax, which has to be paid to Myanmar Tax Authorities. Commercial tax filing can be conducted in monthly/ quarterly basics and the business which charges 5% commercial tax on all sales proceeds shall be returned Form 31 to the customers. KAMP tax department can be to handle all the stuffs of commercial tax filing in line with Myanmar Union Tax Law.

IV. Calculation and Filing of Advanced Corporate Tax

Advanced corporate tax payments are needed to file quarterly installments within 10 days of following quarter throughout the income tax year based on the estimated total income of the business. To lessen/ minimize the penalty of late filing in corporate tax, advanced corporate tax shall be paid throughout the fiscal year and the final date setting off tax liability for the particular fiscal year will be notified by the IRD.

V. Completing Tax Returns & Assessments

KAMP team can able to engage with the tax officer to complete tax returns and assessments for the particular fiscal year and support the needful which are related under tax audit process.